Will Ethereum become a deflationary cryptocurrency, now that The Merge has happened? The answer to this question, in short, can be given in two words: “it depends!” Its long form, however, would offer you a better understanding of whether Ethereum will indeed remain inflationary (albeit only slightly as miners have packed their bags) or become a deflationary asset as time goes on.

At 6:42 AM UTC (2:42 AM EDT / 8:42 AM CEST) on Thursday, September 15, 2022, Ethereum’s long-awaited transition from Proof-of-Work to Proof-of-Stake, dubbed “The Merge”, was finally completed. As Chorus One and the rest of the ecosystem could confirm, the operation — after years of blood, sweat, and delays — was successful.

Having started out as a network relying on Proof-of-Work, thus fast shaping into the “hub” of miners as Bitcoin’s biggest competitor, Ethereum soon encountered scalability issues with its Execution Layer. Too much energy consumption between competing miners to process transactions and not enough security for the network, after all.

The Beacon Chain was, therefore, introduced in December 2020 as the network’s Consensus Layer. This innovation could be seen as Ethereum’s spine, master coordinator, or watchful lighthouse tower, with its key functions set to store data, and manage the network’s validators. Functionalities also included scanning the network, validating transactions, collecting votes, distributing rewards to performing validators, deducting rewards of offline validators, and slashing the ETH of malicious actors.

This Proof-of-Stake blockchain ran alongside the PoW network with the objective to — one day — merge and transform Ethereum into a Proof-of-Stake only network. A win for decentralization and the environment!

That day happened on September 15th, 2022. But before that, Ethereum was inflating at roughly 3.67% — with a ~ 4.62% issuance inflation rate. We will break down the calculations behind this inflation rate, shortly. But first, let’s go back to the drawing board to remind ourselves about the definition of inflation and deflation, in the first place.

Inflation happens when more bills are printed (FIAT money) or more tokens are minted (cryptocurrency) for circulation in the system. The value of the currency then decreases. In FIAT, this means that more bills would be needed to afford things. In certain cryptocurrencies, this means that the price of the currency goes down.

Deflation, on the other hand, happens when tokens are removed or destroyed from the system through “burning”. By logic, the value of the currency is supposed to increase. There are, however, much more complicated dynamics to this. Those won’t be our point of focus, today.

Before The Merge, Ethereum rewarded the capital-intensive mining activity with up to 2.08 ETH approximately every ~ 13.3 seconds. This rounded up to roughly ~ 4,930,000 ETH/year in miners rewards. The network also had around ~ 119.3M ETH in total supply. (Source: Ethereum.org)

We can find the inflation rate by summing up the Executive Layer and Consensus Layer inflation rates.

Then, we move to the Consensus Layer issuance, based on the amount of ETH staked. We’ll round up that number to 13,000,000 of staked ETH presently.

That’s almost Net Zero!

Summing both figures, we had an issuance inflation rate of ~ 4.62%, pre-Merge. In other words, miners made approximately ~ 89.4% of issued ETH whilst stakers got ~ 10.6% of the pie as ETH’s issuance inflated at ~ 4.62%.

Goodbye miners. Stay on, stakers!

We’ll get to understand how not addressing high gas fees could actually be a plus for “Deflationary Assets” or “Ultra Sound Money” advocates.

As we go back to the drawing board for the second time in our walk-through, let’s revisit the difference between inflationary, deflationary, and disinflationary crypto assets.

Some cryptocurrencies’ tokenomics are set-up to increase token supply over time. From the start, they are “programmed” to be inflationary. Other cryptocurrency projects, which propose unlimited coin supply, are inflationary as well — as unlimited supply is bound to outweigh demand, decreasing the currency’s value over time. An example of a coin with unlimited supply is DOGECOIN.

With its halving mechanism until the last 21 millionth Bitcoin is minted, Bitcoin is a disinflationary cryptocurrency. It is set up for a chronological decrease in its issuance. A disinflationary cryptocurrency can, in other words, be described as “an inflationary cryptocurrency with disinflationary measures” in the sense that the demand may, over time, become greater than the diminishing issuance of new tokens.

A good example of a deflationary cryptocurrency is the Binance Coin. BNB’s initial supply saw 200,000,000 tokens in circulation. At the end of Q3, nearly 40 million BNBs had been burned as part of the plan to halve the initial supply from 200 million to 100 million.

Look at tokens in circulation as a balloon and issuance as air: BNB’s mechanism is to deflate the balloon till 50% of air in it remains whilst Bitcoin’s mechanism is to keep inflating its balloon with a set maximum air supply, but doing so with a little less air at every pump.

So what about Ethereum, now that The Merge has basically rendered a close to Net Zero inflation rate? Why is it touted as a potential deflationary coin?

Enter EIP-1559, the mechanism that burns a portion of ETH gas fees during transactions on the network. With the inflation rate already dropping to 0.49% as explained above, EIP-1559 has the potential to decrease ETH supply — but only on the condition that the gas prices are above 15 Gwei.

Consequently, it is no surprise that ultra sound money advocates would plead users to set their ETH transaction fees to a minimum 15.1 gwei.

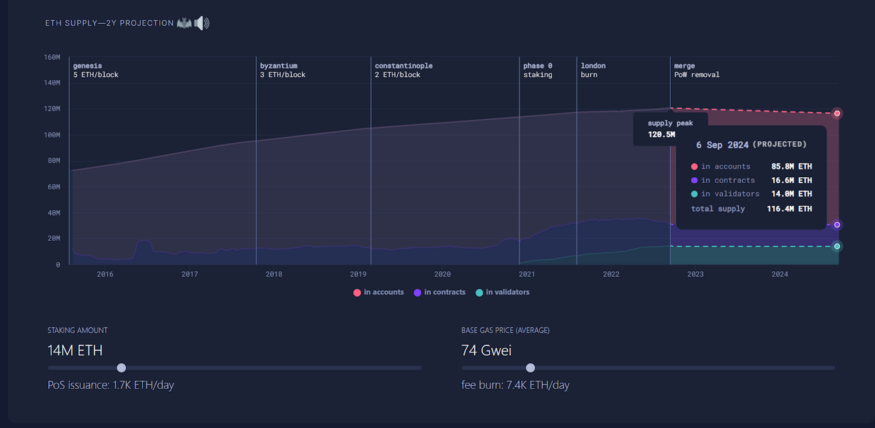

Ultrasound.money tracks Ethereum’s supply in real time. A negative figure reflects how many ETHs have been burned since The Merge. In other words, a negative figure showcases deflation, whilst a positive figure showcases inflation.

32 hours into The Merge era, Ethereum had issued over 376 more ETH. Inflationary.

A month on and the figures keep rising…

Or maybe not… a wider perspective shows us that there has actually been a decrease since October 8th, when the issuance peaked at over 13,000 ETH.

Ethereum — Deflationary or not?

Ultrasound.Money projects gas fees to be above 70 Gwei, registering a -3.40% supply decrease across the next two years.

As we’ve witnessed now, four weeks since The Merge, we’re bound to see periods of a deflationary ETH and periods with a low but healthy inflation — both of which would be vital for an economic equilibrium.