People like to say that those who cannot remember the past are condemned to repeat it. However, sometimes forgetting the past is a deliberate choice: an invitation to build on completely new grounds, a bet that enables a different future.

All bets have consequences. Specifically in crypto, many of t hese consequences are so material t hat t hey become hard to comprehend: hundred-million dollar exploit after exploit, billions vanishing in thin air... In its relatively short history, Ethereum has made many bets when deciding what the optimal protocol looks like. One such gamble was the decision to not enshrine native delegation into their Proof-of-Stake protocol layer.

Before the Merge, the standard PoS implementation was some sort of DPoS (Delegated Proof-of-Stake). The likes of Solana and Cosmos had already cemented some of the ground work, with features like voting and delegation mechanisms becoming the norm. Ethereum departed from this by opting for a purePoS design philosophy.

The thought-process here had to do with simplicity but even above this, the goal was to force individual staking for a more resilient network: resilient to capture and resilient to third-party influence, whether in the form of companies or nation states.

How successful have these ideas been? We could write ad infinitum about the value of decentralization, creating strong social layers and any other such platitudes, but we believe there’s more weight in real arguments. In this analysis we want to expand on the concepts and current state of the liquid staking market and what it actually means for the future of Ethereum. Also, we talk about the role of Lido and other LST protocols such as Stakewise in this market.

If t ere’s some hing that history has shown us is that derivatives can strengthen markets. This is true of traditional commodities where the underlying asset is difficult or impossible to trade, like oil, or even mature financial instruments, like a single stock becoming a complicated index. In fact, the growth in the use of derivatives has led to exponential growth in the total volume of contracts in our economy.

It is common as well that in most markets, the volume of derivatives greatly surpasses the spot, providing significant opportunities across a large design space. It might sound familiar (and we will get to crypto in a moment), but this open-design space has posed major challenges for risk-management practices in the already mature traditional finance, in areas such as regulation and supervision of the mechanisms, and monetary policy.

Liquid tokens are one of the first derivative primitives developed solely for the crypto markets, and have greatly inherited from their predecessors. When designing these products in the context of our industry, one has to account not only for the protocol-specific interactions, but also the terms of regulation (from the internal governance mechanisms and also in the legal sense), fluctuating market dynamics and increasingly sophisticated trading stakeholders.

Let ’s review some of Ethereum’s design choices, and how they fit into t his idea. Ethereum has enforced some pretty intense protocol restrictions on staked assets, famously their 32ETH requirement per validator and lack of native delegation. Game theory has a notoriously difficult reputation in distributed systems design. Mechanisms for incentivizing or disincentivizing any behavior will typically almost always have negative externalities.

Also, on-chain restrictions tend to be quite futile. In our last edition, we discussed some effects that can be observed in assets that resemble “money ”, like the token markets of LSTs, including network effects and power law distributions. But now we want to go deeper and consider, why is Liquid Staking so big in Ethereum and not other chains?

We observe a clear relationship between the existence of a native delegation mechanism and the slower adoption of Liquid Staking protocols. In that sense, other chains have enshrined DPoS, which makes it significantly less likely to result in high-adoption or a similar dynamic, whilst Ethereum has found it self increasingly growing in that direction.

We observe the results of the restrictions imposed at the protocol level. The network *allows* stake to be managed by individual actors, but there is no way to prevent aggregation or pooling. No matter how many incentives you create for the behavior on-chain to be as observable and maximally auditable as possible, the reality is that as it stands, the effect is never auditable.

At the time of writing this analysis, Lido has managed to concentrate 31.76% of the market share for staking in Ethereum under its signature token stETH. This is an out standing figure, not only in absolute terms but also relative to its position in the Liquid Staking market, where it controls an extraordinary ~80%, with close to 167,000 unique depositors on their public smart contracts. It is, by a margin, the largest protocol in crypto by Total Value Locked.

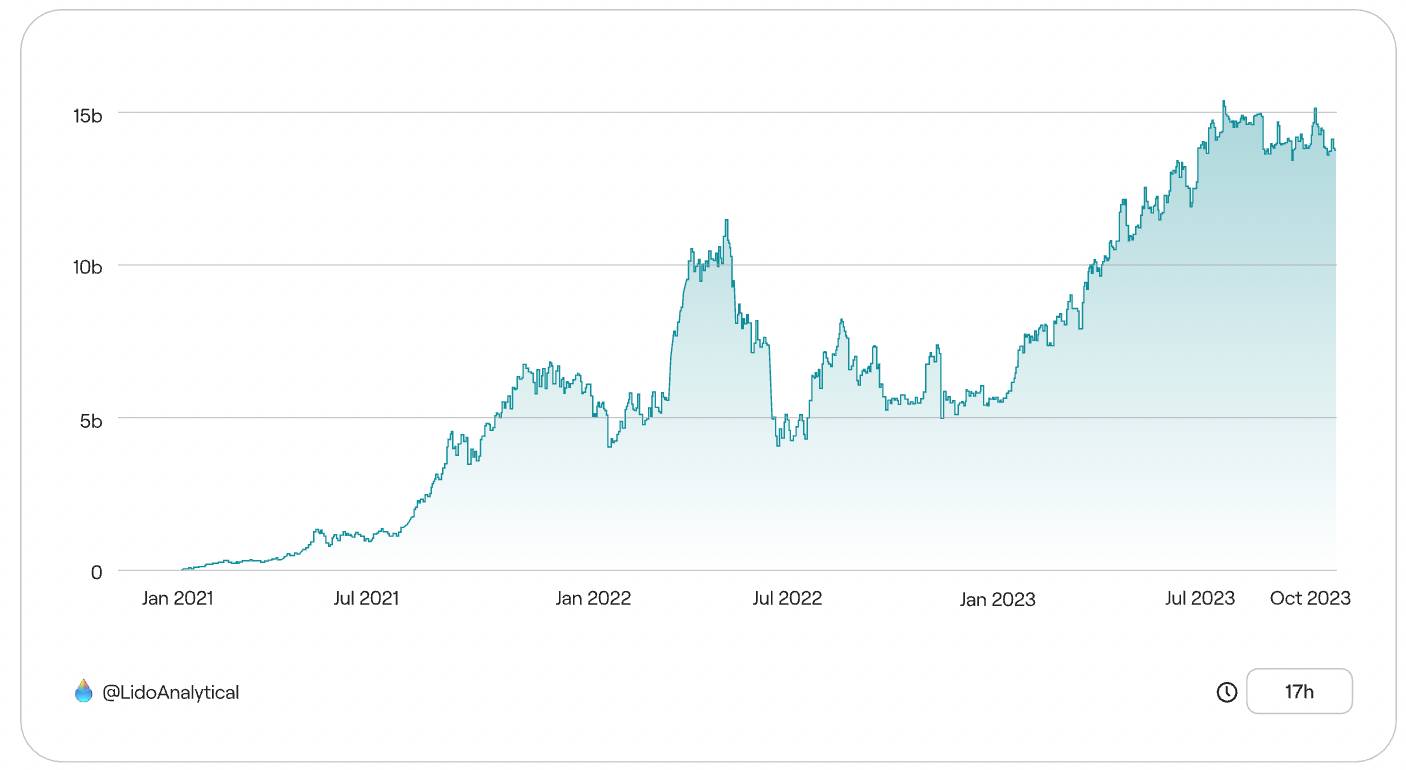

A big issue with TVL is that it is heavily dependent on crypto prices. In the case of Lido, we actually observe that the inflow charts show a constant growing trend from protocol launch to the present day. This is independent from the decreased crypto prices, minimal transaction output on-chain and t e consequent inferior returns on the asset, with an APR that moves in between 3.2 and 3.6% on the average day. This is of course, below the network average for vanilla nodes considering the protocol takes a 10% cut from staking rewards, divided between the DAO and its 38 permissioned Node Operators.

Recently, there’s been heated debate related to the position and surface of Lido inside Ethereum, as it relates to decentralization concerns and a specific number that constantly pops up. What is this 33.3% we keep hearing about ?

There are two important thresholds related to PoS, the first one being t his 33.3 percent number; which in practical terms means that if an attacker could take control of that surface of the network they would be able to prevent it from finalizing... at least during a period of time. This is a progressive issue with more questions than answers: what if a protocol controls 51% of all stake? How about 100%?

Before diving into some arguments, it is interesting to contextualize liquid ETH derivatives as they compare to native ETH. In the derivatives market, the instrument allows the unbundling of various risks affecting the value of an underlying asset. LSTs such as stETH combine pooling and some pseudo-delegation, and although this delegation is probably the main catalyst of high adoption, it is the pooling effect that has a huge effect on decentralization. As slashing risk is socialized, it turns operator selection into a highly opinionated activity.

Another common use of derivatives is leveraged position-taking, in a way the opposite of the previous one that is more focused on hedging risk. This makes an interesting case for the growth of stETH, as in a way its liquidity and yielding capabilities are augmenting native ETH’s utility. There is no reason you cannot, for example, take leveraged positions in a liquid token and enjoy both sources of revenue. At least, this is true of the likes of stETH which have found almost complete DeFi integration. As long as they are two distinct assets, one could see more value accrual going to derivatives, which is consistent with traditional markets.

This growth spurt is an interesting subject of study by itself, but we think it would be also possible to identify growth catalysts, and also apply them across the industry, to discover where some other undervalued protocols might exist if any. For this, you would want to identify when the protocol had growth spurts, find out which events led to that and search for these catalysts in other protocols.

One such example comes when protocols become liquid enough to be accessible to bigger players.

What would happen if we addressed so-called centralization vectors, and revisited the in-protocol delegation. Or more realistically, if we had the chance to reduce the pooling effect and allowed the market to decide the distributions of stake, for example, by having one LST per node operator.

Alternatives like Stakewise have been building in that design space to create a completely new staking experience, one that takes into account the past.

In particular, Stakewise V3 has a modular designt hat mimics network modularity, against more monolithic LST protocols. For instance, it allows stakers the freedom to selectt heir own validator, rather than enforcing socialized pooling. The protocol also helps mitigate some slashing risk, as losses can be easily confined to a single “vault”. Each staker receives a proportional amount of Vault Liquid Tokens (VLT) in return for depositing in a specific vault, which they can then mint into osETH, the traded liquid staking derivative.

Although not without its complexities, it offers an alternative to the opinionated nature of permissioned protocols like Lido, in an industry where only a better product can go face to face with the incumbent.

If you design a system where the people with the most stake enforce the rules and there is an incentive for that stake to consolidate, there’s something to be said about those rules. However, can we really make the claim that t here’s some inherent flaw in the design?

One of the points that get brought up is in the selection of the protocol participants. However, a more decentralized mechanism for choosing node operators can actually have the unintended result of greater centralization of stake. We need only to look at simple DPoS, which counts into its severe shortcomings a generally poor delegate selection with very top heavy stake delegation and capital inefficiency.

Another issue has to do with enforcing limits on Liquid Staking protocols, or asking them to self limit in the name of some reported values. This paternalistic attitude punishes successful products in the crypto ecosystem, while simultaneously asserting the largest group of stake in a PoS system is not representative of the system. Users have shown with their actions that even with LST or even DPoS downsides (all kinds of risk, superlinear penalty scaling) this is still prefered to the alternative of taking on technical complexity.

An underlying problem exists in the beliefs that control a lot of Ethereum’s design decisions, meaning that all value should accrue to just ETH and no other token can be generating value on the base layer. This taxation is something that we should be wary of, as it is very pervasive in the technocracies and other systems we stand separate to. Applications on Ethereum have to be allowed to also generate revenue.

Ultimately, the debate about Lido controlling high levels of stake does seem to be an optics issue, and not an immediate threat to Ethereum. Moreover, it is the symptom of a thriving economy, which we have observed when compared to the traditional derivatives market.

Ethereum’s co-founder, Vitalik Buterin, recently wrote an article out lining some changes that could be applied to protocol and staking pools to improve decentralization. There he outlines the ways in which the delegator role can be made more meaningful, especially in regards to pool selection. This would allow immediate effects in the voting tools within pools, more competition between pools and also some level of enshrined delegation, whilst maintaining the philosophy of high-level minimum viable enshrinement in the network and the value of the decentralized blockspace that is Ethereum’s prime product. At least, this looks like a way forward. Let ’s see if it succeeds in creating an alternative, or if we will continue to replicate the same faulty systems of our recent financial history.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.