We are thrilled to share the latest update from the EigenLayer ecosystem – a highly anticipated upgrade that promises to provide stakers with greater control and flexibility over their staked assets. Effective today, April 9th, the EigenLayer mainnet launch unlocks a suite of new features and functionalities for both stakers and node operators.

EigenLayer M2 builds upon the existing M1 contracts that have been operational on the Ethereum mainnet. This major upgrade introduces a crucial new capability: the ability for users to delegate their restaked Ethereum (ETH) or liquid staking tokens (LSTs) to the node operator of their choice.

And as one of the leading node operators, we’re thrilled to announce that users can now delegate their restaked Ethereum (ETH) and Liquid Staking Tokens (LSTs) to Chorus One!

Delegating to Chorus One is a seamless and secure experience. Users can easily delegate to Chorus one via any of the following options:

OPUS Pool is designed to make the restaking process effortless for our users. Here's a quick guide on how to delegate your assets through the OPUS Pool:

You can find the detailed, step-by-step guide for OPUS Pool here: https://chorus.one/articles/your-guide-to-opus-pool-stake-mint-oseth-and-restake-with-eigenlayer

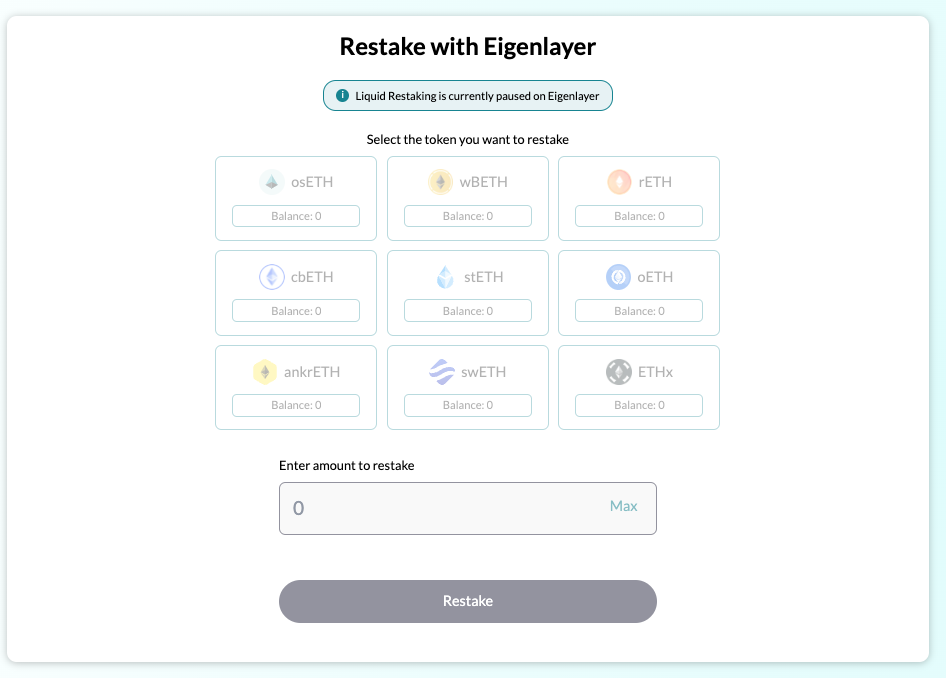

Note: Restaking LSTs with EigenLayer is currently on hold and will resume once the deposit cap is raised. In the meantime, you are welcome to use OPUS Pool to stake any amount of ETH, mint osETH, and delegate your existing restaked LSTs.

.png)

Alternatively, you can directly delegate your assets to Chorus One via the EigenLayer dashboard. Here's how it works:

By choosing either OPUS Pool or Chorus One’s operator profile on the EigenLayer dashboard, you can seamlessly delegate your assets to Chorus One and benefit from our tailored approach, enhanced MEV rewards, and top-tier security measures.

Please Note: The upgrade doesn't yet allow Operators to earn yield for services provided to an AVS or to be at risk of slashing for Operator misbehaviors.

At the heart of the M2 upgrade is the introduction of delegation capabilities, empowering stakers to choose the node operator they wish to delegate their assets to. Specifically, the M2 contracts will enable users to deposit their Ethereum (ETH) or liquid staking tokens (LSTs) into EigenLayer through the StrategyManager (for LSTs) or the EigenPodManager (for beacon chain ETH). Additionally, stakers will now be able to withdraw their assets via the DelegationManager, regardless of the asset type.

For node operators, the M2 upgrade introduces the ability to opt-in to providing services for Actively Validator Services (AVSs) using the respective AVS's middleware contracts. However, the current iteration of the M2 contracts does not yet enable node operators to earn yield for the services they provide to AVSs or expose them to the risk of slashing for any potential misbehaviors.

In contrast to node operators who may prioritize onboarding as many AVSs as possible, Chorus One has adopted a more strategic and selective approach. Security is of paramount importance to us, and we meticulously vet each AVS before providing infrastructure support.

Our dedicated team thoroughly assesses the technical architecture and risk profile of every AVS under consideration. We leave no stone unturned, carefully evaluating factors such as the robustness of their systems, the soundness of their security protocols, and their overall risk appetite. Only those AVSs that meet our stringent criteria are granted access to our staking infrastructure.

This selective approach ensures that our users can have the utmost confidence in the management of their assets. By entrusting their stakes to Chorus One, our customers can rest assured that their funds are being handled with the highest levels of diligence and care, safeguarded by our rigorous vetting process.

To learn more about Chorus One's tailored approach to restaking, we encourage you to reach out to our team at staking@chorus.one. Our team will be happy to answer any questions you might have.

Ready to get started? Visit OPUS Pool and follow our detailed guide to easily delegate your assets to Chorus One.

The technical details of the M2 upgrade can be found in the official EigenLayer documentation, available at https://github.com/Layr-Labs/eigenlayer-contracts/tree/dev/docs. As the EigenLayer ecosystem continues to evolve, this latest milestone towards Mainnet promises to empower stakers and node operators alike, ushering in a new era of flexibility and control.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

OPUS Pool, powered by Stakewise, enables you to stake any amount of ETH with Chorus One, mint osETH, and directly deposit into EigenLayer in one flow. With the launch of Delegation on Eigenlayer you can now easily delegate your restaked position to Chorus One with a single click of a button.

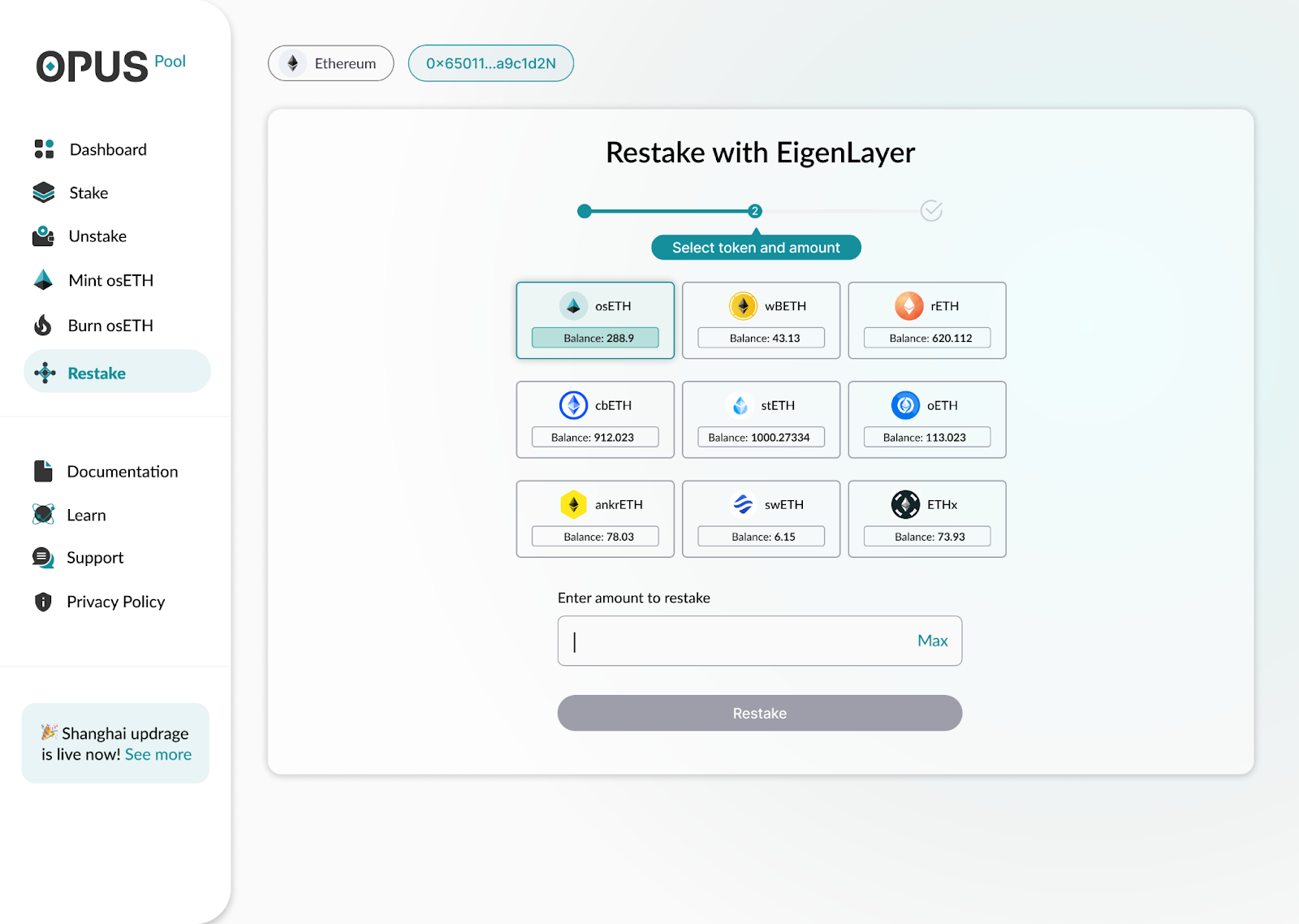

Not only that, users may bring in liquid staking tokens (LST's) from any external platform, including osETH, wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx, and directly restake with EigenLayer if they wish to do so.

Start using OPUS Pool to stake ETH. Visit https://opus.chorus.one/pool/stake/

OPUS Pool facilitates greater participation in securing the network but also allows a wider range of Chorus One stakers to earn rewards and gain access to a suite of benefits, including top-tier MEV yields, low fees, and the assurance of enterprise-grade security, among others.

Opus Pool brings in a host of benefits for users. Let’s take a brief look at what you stand to gain.

1. Stake any amount of ETH and mint osETH

OPUS Pool enables a user to stake any amount of ETH (no 32 ETH minimum requirements) and receive rewards instantly. Additionally, users have the ability to mint osETH, a liquid staking derivative, and use it in DeFi or deposit into EigenLayer to gain additional rewards directly on OPUS Pool in one go.

2. Low Fees

OPUS Pool sets itself apart from current liquid staking protocols by offering users the advantage of highly competitive staking fees. At just 5%, our fees are among the lowest in the industry, making it more accessible for a broader spectrum of users to stake their ETH and earn rewards.

3. Top-tier MEV Rewards

As pioneers in MEV research, our latest ace, Adagio - an MEV-Boost client, allows for more efficient interactions with Ethereum’s transaction supply chain, directly enhancing MEV rewards for stakers. Fully integrated with OPUS Pool validators, Adagio ensures that anyone staking on OPUS Pool can benefit from these increased MEV rewards.

Want to learn more about Adagio and its mechanics? Read all about it here.

4. Restake osETH, stETH, cbETH, rETH with EigenLayer in One Go.

OPUS Pool offers a unique feature: users can deposit not only osETH minted through OPUS Pool but also liquid staking derivatives like stETH, cbETH, and rETH minted on other platforms, directly into EigenLayer.

The OPUS SDK: In addition to the benefits mentioned above, our Institutional clients can leverage the OPUS SDK to integrate ETH staking directly into their UI, providing their customers with all the benefits of the OPUS Pool seamlessly. To know more, please reach out to staking@chorus.one.

Now, let’s move on to the guide.

1. To start staking, head over to https://opus.chorus.one/pool/stake/ and connect your wallet.

2. Select your desired wallet. Note that you can use WalletConnect if you want to connect through Ledger Live.

3. Once connected, make sure you are on the Stake tab. You can see all the tabs on the left-hand-side of the screen.

3. Enter the amount you would like to stake. You can see the estimated amount of daily/monthly/yearly rewards you will earn with this amount of stake.

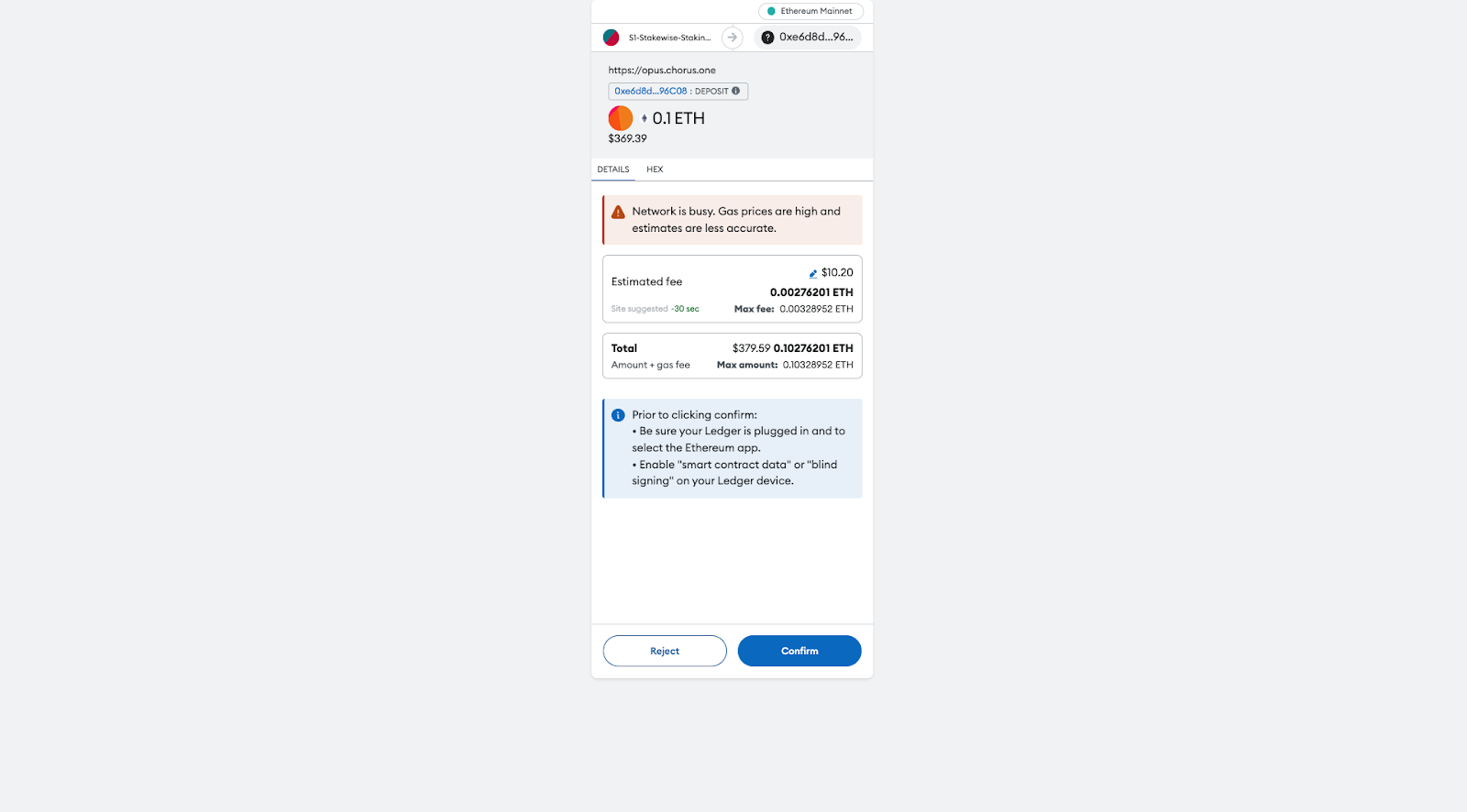

4. Hit Confirm and Stake button and sign the transaction in your wallet

5. Congratulations, you have now successfully staked your ETH! As a next step you can go to the dashboard to look at the summary of your staking position or you could head over to the Mint osETH section under Staking tab to mint some liquid staking tokens for your staked position

1. In case you want a liquid token representation of your stake you can head over to the Mint osETH section under the Staking tab on the left of the screen. You will see the amount of ETH you have staked. You will also see the amount of osETH you have already minted (if any).

2. Enter the amount of ETH you would like to use to mint osETH.

3. Click on Mint button and approve the transaction in your wallet

4. Congratulations! You have successfully minted osETH for your staked ETH. You can now head over to the dashboard to view your staked position and osETH summary. You can alternatively restake your osETH to Eigenlayer.

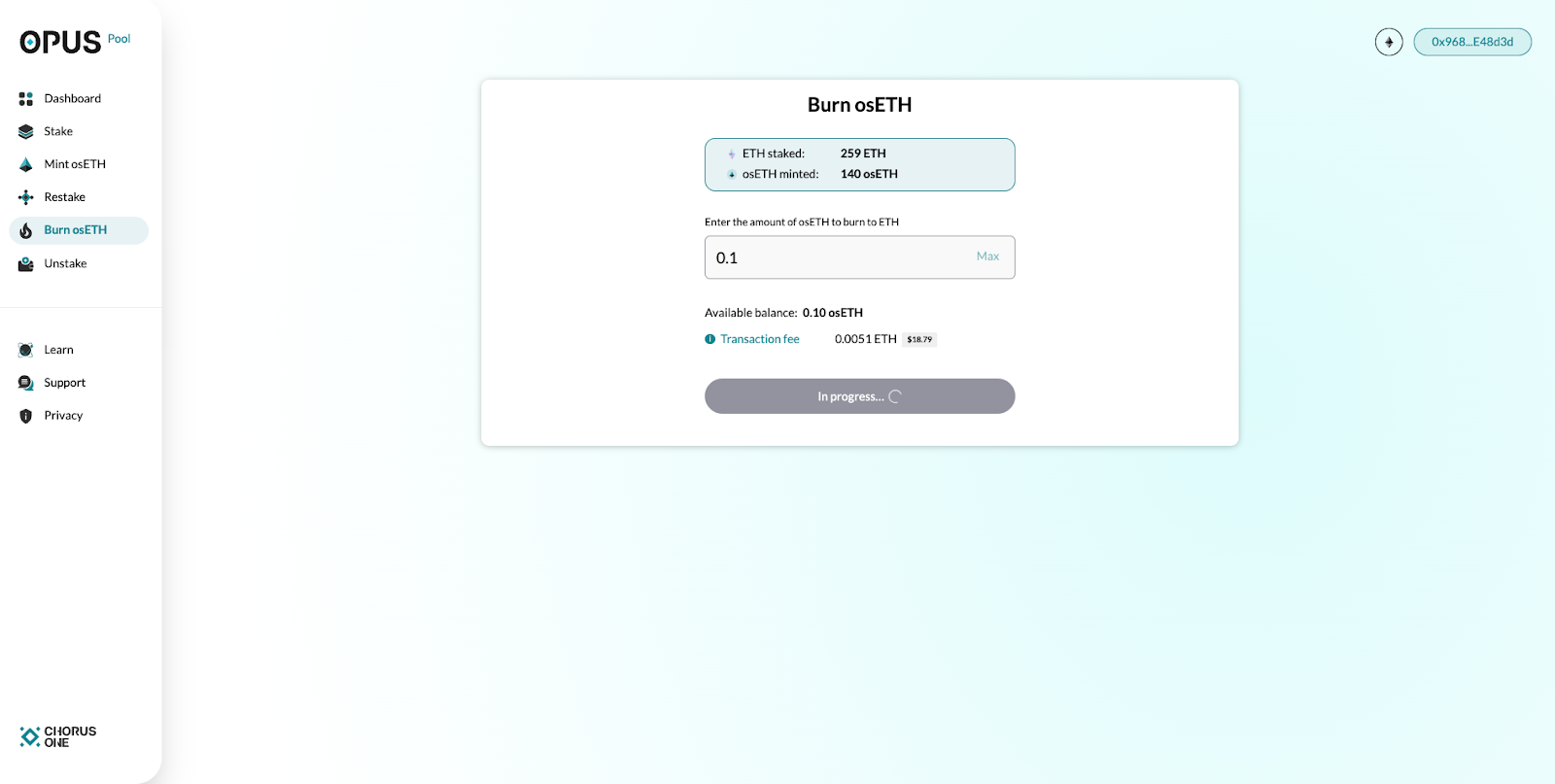

5. In case you want to reverse the minting process, you can burn your osETH to get ETH back. Select the Burn osETH section under the Staking tab on the left menu, enter the amount you would like to burn and hit Burn

6. Once you click on Burn, you will be prompted to sign the transaction in your wallet. Upon signing, you will have successfully completed the burn process

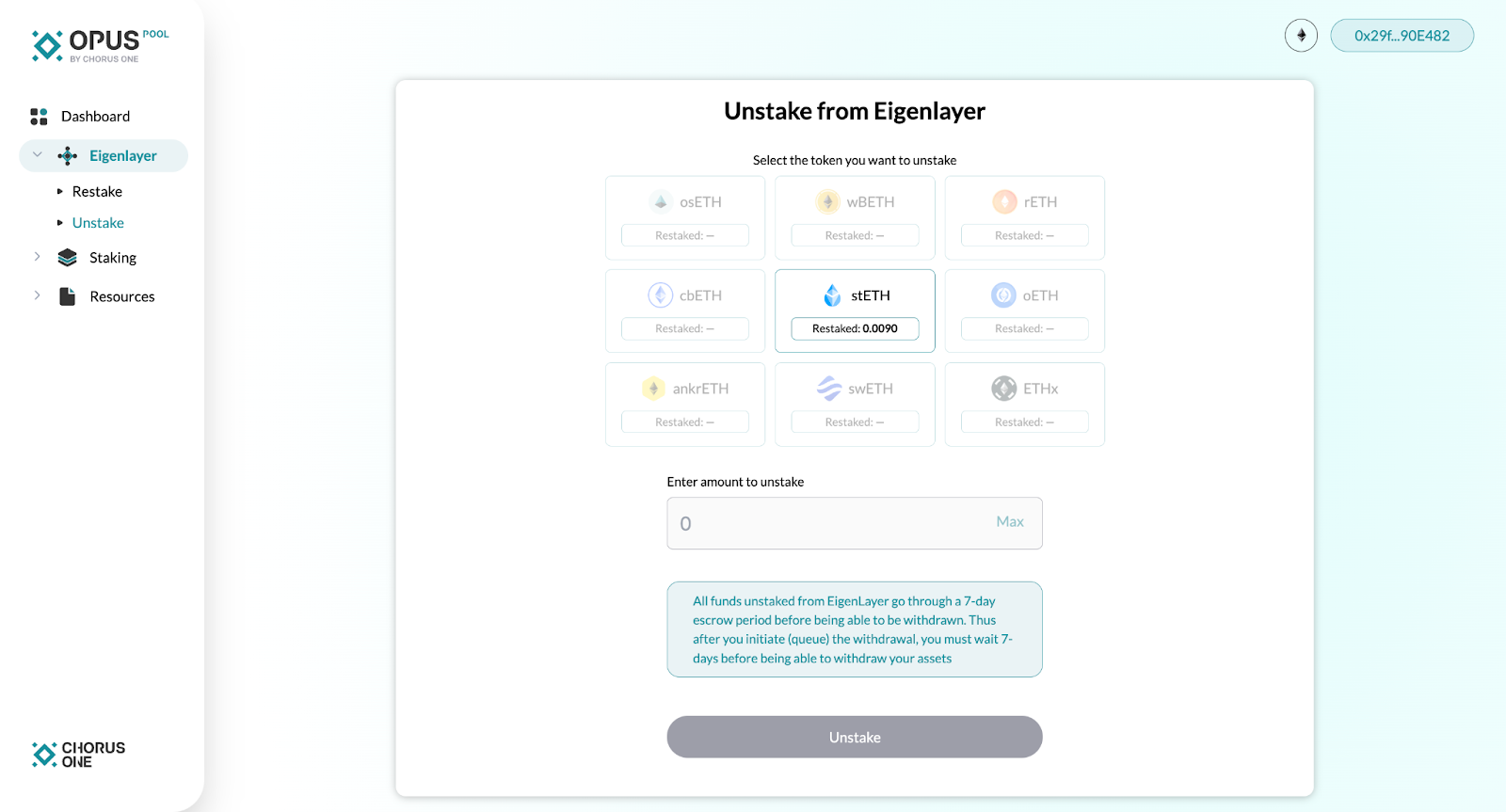

1. To deposit your osETH, or any accepted staked ETH into EigenLayer including wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx, click on ‘Restake’ in the menu bar and select the asset you wish to deposit.

2. Note: EigenLayer intermittently pauses staking when the limits for restaking have exhausted. They usually announce the lifting of the limits on their Twitter and discord. You might encounter the following screen when there is a pause by the Eigenlayer team.

3. In case deposits into Eigenlayer are live you may select the LST that you possess, enter the desired amount that you would like to restake and hit the Restake button

4. You will be prompted to approve the restaking transaction first and then finally sign the restaking transaction in your wallet.

5.Once you sign, you will have successfully restaked to Eigenlayer. In case you delegated to Chorus One operator earlier, your restaked assets will be automatically delegated. If not, you can go back to the dashboard to delegate your assets to Chorus One or view the summary of your staked position.

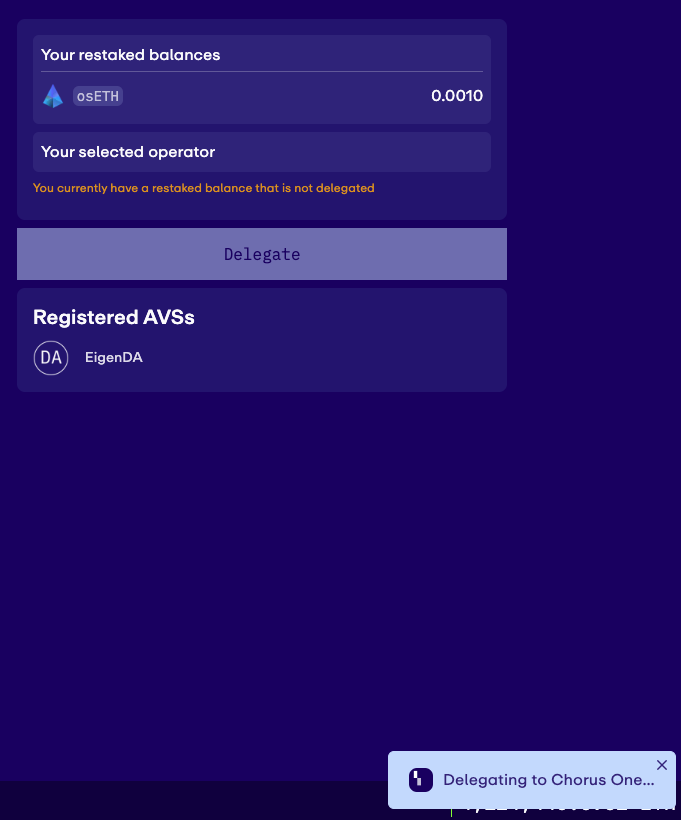

1. Eigenlayer recently launched their delegation manager contract and enabled staker delegations. This will allow anyone with restaked ETH or restaked LSTs to delegate their restaked position to an operator of their choice. To delegate your stake to Chorus One, head over to the dashboard by clicking on the Dashboard button on the left navigation bar.

2. In case you have not already delegated to another operator, you can click on the Delegate to Chorus One button.

3. You will be prompted to sign a transaction in your wallet. Once you sign, you will see the following screen. Congratulations your restake position is now successfully delegated

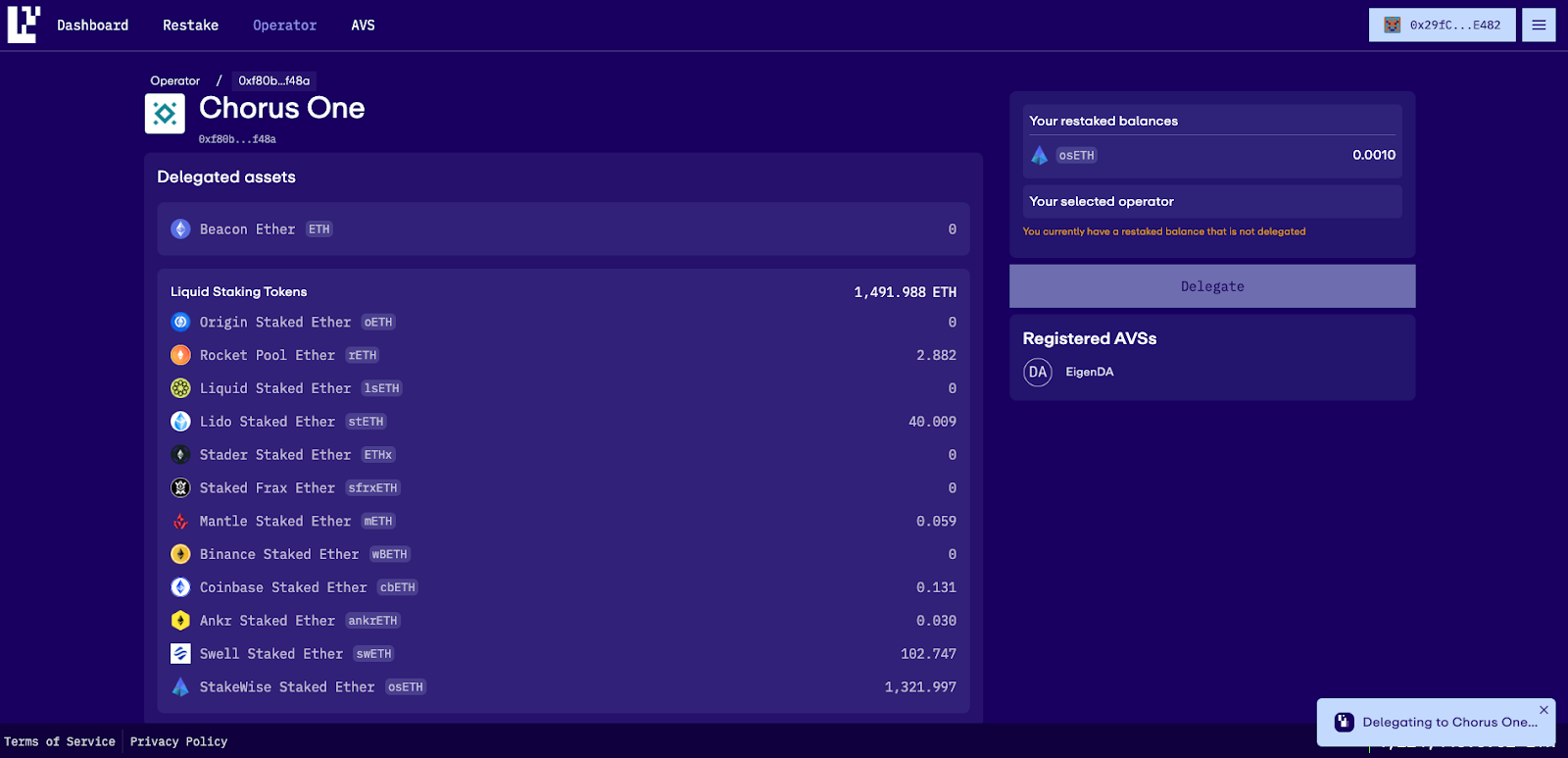

4. Alternative, you can go directly to Eigenlayer App - https://app.eigenlayer.xyz/operator and search for Chorus One operator

5. Click on the Chorus One card that shows up

6. If you have not previously delegated to any operator, you will see a Delegate button on the right of the screen. You will also see a message “You currently have a restaked balance that is not delegated”. Click on the delegate button and sign the transaction in the wallet.

7. Congratulations you have successfully delegated your stake

Switching node operators means moving your restaked funds from supporting the original node operator supported AVSs to Chorus One supported AVSs.

Note: Switching operator requires you to sign 3 transactions. The first transaction queues the withdrawal of your restaked assets. This is a prerequisite of the Undelegation function. The second transaction undelegates your restaked position. The final transaction delegates to Chorus One. You will need to restake your assets again after you switch the operator. You may not be able to restake your assets until Eigenlayer reopens the deposit cap.

2. Click on Switch Operator and sign the transaction in the wallet

3. You will see another transaction pop up to undelegate from the operator. Sign the undelegation transaction

4. Finally you will see your wallet prompt you to sign the delegation transaction which delegates to Chorus One. This is the final transaction in this process

5. Once the transaction is confirmed you will have successfully delegated to Chorus One. Make sure to go back to the restaking tab and start restaking your assets

1. To unstake from OPUS Pool, go to the Unstake Section under the ‘Staking’ tab in the menu on the left navigation bar.

2. Enter the amount of ETH you would like to unstake and hit the Unstake button

Note: If you minted osETH at any point any time against your staked position, you might have to burn that amount to unstake all your ETH

3. You will be prompted to sign the unstake transaction in your wallet. You have successfully unstaked your position. Once you unstake your ETH enters the withdrawal queue. You will see a progress bar right below the success message that lets you know the status of your withdrawable stake. Once it becomes ready for withdrawal you will see a button to claim the stake back into your wallet.

4. You can come back to the Unstake tab at a later point and check the status of your withdrawal.

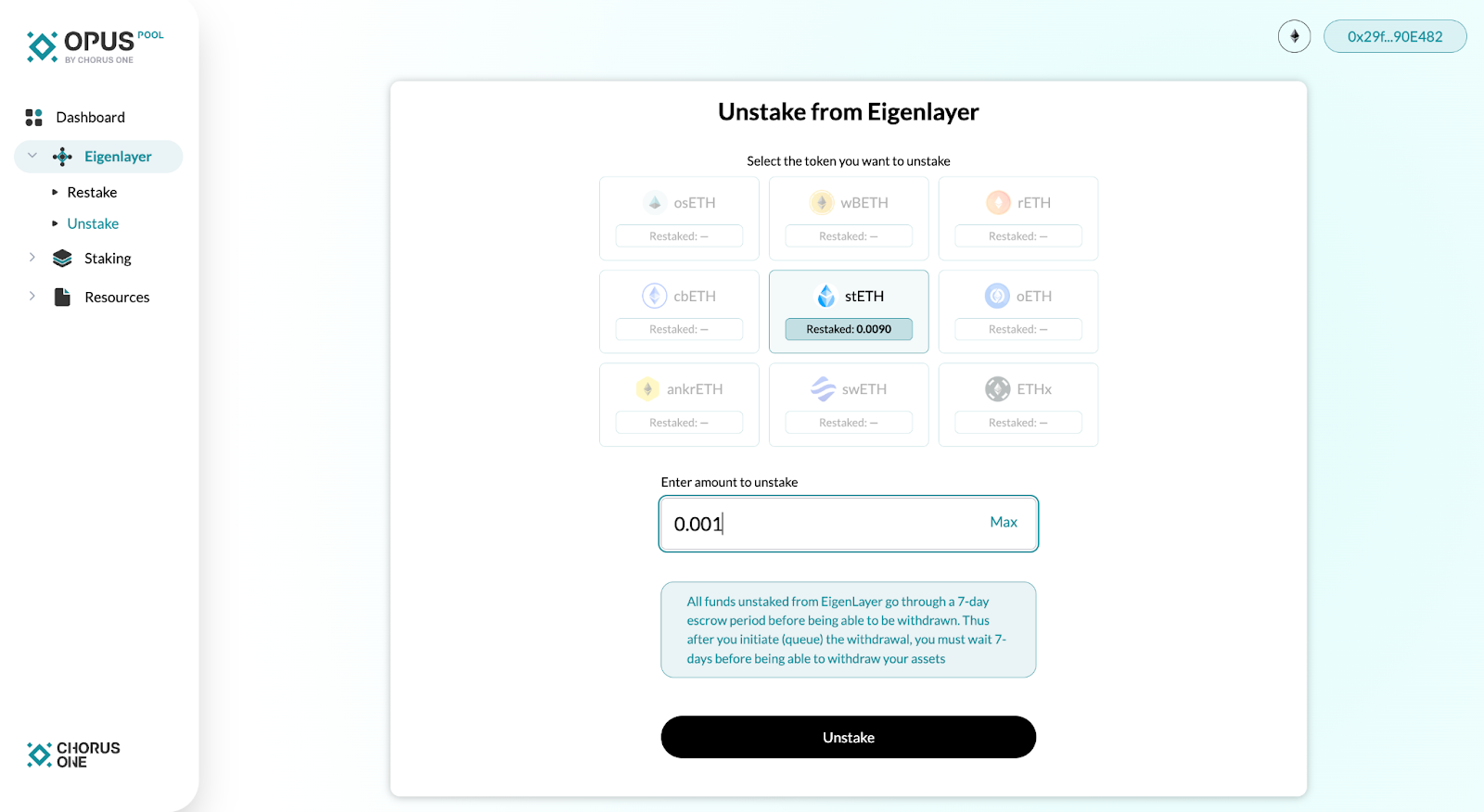

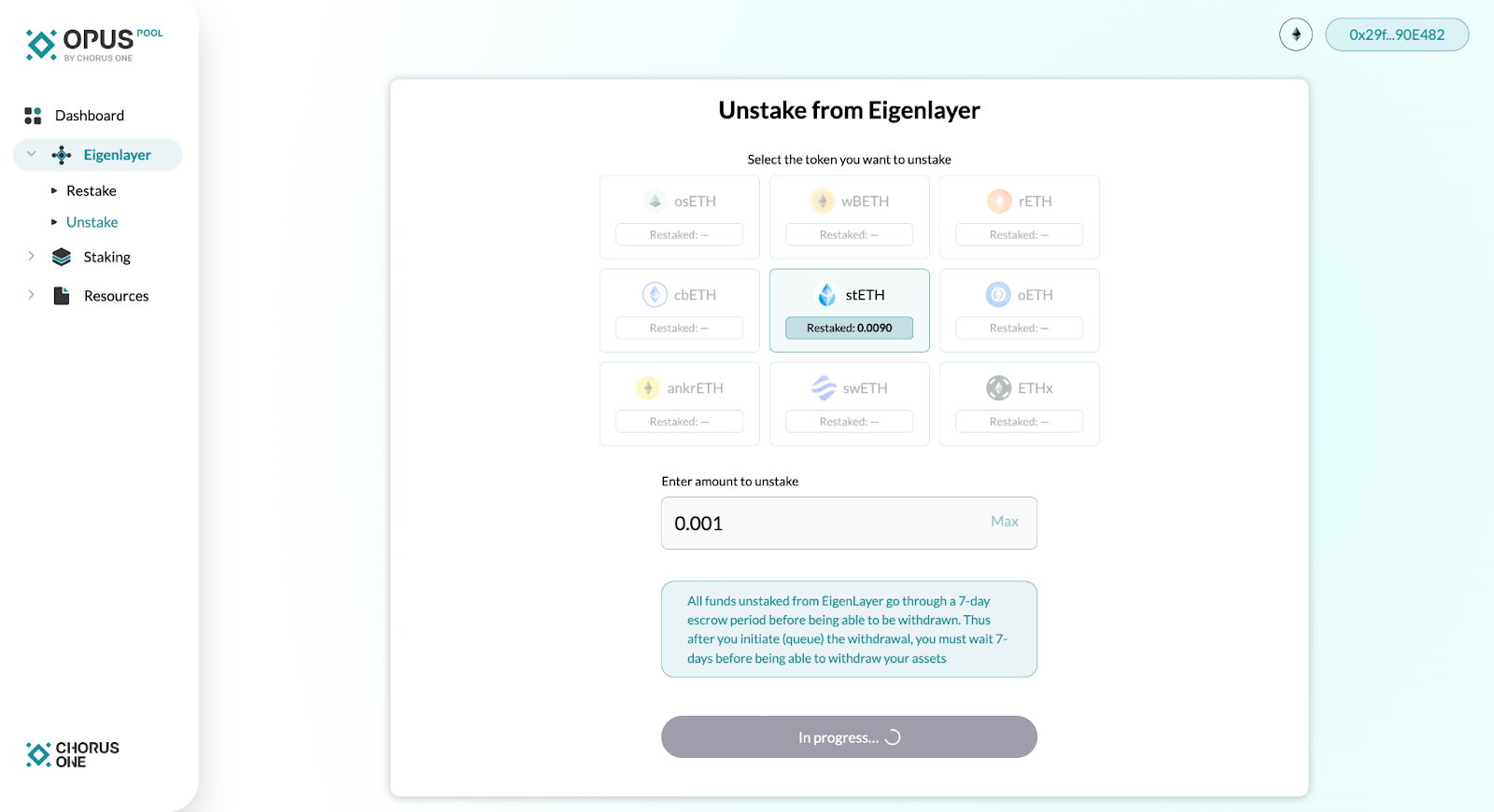

2. Select the LST you want to unstake and enter the amount

3. Hit the Unstake button and sign the transaction in the wallet

4. You have successfully unstaked.

Resources

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Chorus One is proud to be a validator on Berachain, a high-performance modular EVM compatible blockchain powered by Proof-of-Liquidity. In this article, we provide an overview of everything you need to know about Berachain, how it works and use cases.

Berachain, currently in Testnet phase, is changing how DeFi users access liquidity, supercharging applications, and providing flexibility and adaptability to the thriving digital economy. It combines the capabilities of the Cosmos SDK and introduces its novel 'Proof of Liquidity' as well as their new modular implementation of the EVM called Polaris. This not only tackles current obstacles but also paves the way for fresh avenues of creativity and advancement within the DeFi industry.

Berachain is a DeFi-focused Layer 1 blockchain running on Proof of Liquidity consensus built on the Cosmos SDK. Berachain emphasizes modularity in its design approach. By incorporating Polaris, Berachain not only ensures EVM compatibility but also supports a modular framework that allows for easy separation of the EVM runtime layer and crafting stateful precompiles and unique modules enabling the creation of smarter and more effective contracts.

Berachain operates a tri-token system: BERA (native token of Berachain i.e gas), HONEY (stablecoin) and BGT (governance token). Berachain Blockchain also provides a user-friendly interface and a comprehensive array of tools for developers and builders to create and deploy their applications.

Proof of Liquidity is a concept introduced by the Berachain team that enables users to stake various tokens and delegate this stake to validators. Users can stake assets like BTC, ETH, L1 tokens wBTC, wAVAX, wETH, wADA, and stablecoins.

Proof of liquidity models seeks to address challenges in common decentralized systems like liquidity fragmentation and stake centralization. Though Proof of Liquidity builds on the concept of proof of stake, the token used for staking is no longer the same token used for many on-chain actions. Moreover, the sole way to acquire new governance tokens (BGT) is through providing liquidity into DeFi applications.

Image source: Berachain Documentation

The concept behind PoL implies that users stake different tokens to enhance the chain's liquidity and bolster the Layer 1 security at the same time. This setup enables users to earn fees by contributing liquidity through staking while also receiving block rewards. Moreover, users have the option to mint HONEY by providing assets as collateral and utilize them within the Berachain ecosystem without constraints.

Berachain's EVM compatibility is derived from the Berachain Polaris EVM library, which enhances the EVM experience compared to the traditional Ethereum setup. Polaris Ethereum not only provides the standard Ethereum features but also empowers developers with the ability to design stateful precompiles and custom modules for crafting smarter and more robust contracts.

Polaris can be easily integrated into any consensus engine or application, including Cosmos-SDK. This modular approach streamlines the EVM integration process and reduces the time and overhead cost for developers to implement their own EVM features.

For DeFi Users - Berachain BEX

BEX is Berachain’s decentralized exchange that allows users to add liquidity to an asset pool and receive trading fees and incentives.

BEX introduces the concept of House pools, which serve as the backbone of the exchange. These default pools hold significant importance as they generate BGT rewards, which could be staked later with validators to participate in governance.

BEX also introduces Metapools, a liquidity pool where LP tokens can then be used as part of an asset pair in another pool, helping to increase capital efficiency across the chain.

Berachain Bends allow users earn interest and rewards by supplying assets like (ETH, BTC, and USDC) and borrowing HONEY. On Bend users can deposit collaterals to contribute to the platform liquidity, earn BGT rewards by utilising and borrowing HONEY within the ecosystem.

Berps

Berps by Berachain (Perpetual Futures Contract Trading) provides users with endless trading opportunities with a wide array of asset access EVM and Cosmos. It is liquidity efficient, robust and easy to use.

Chorus One will be providing staking services and contributing extensive knowledge in infrastructure development to the network. Our role as validators in the Berachain community symbolizes a collaborative effort aimed at delving into new horizons and enhancing the potential within this ecosystem.

Users providing liquidity in the BEX liquidity pools will gradually accumulate BGT, and can be used to create and vote on governance proposals such as proposals that decide on which LP pools receive BGT emissions. BGT can also be burned 1:1 for BERA. This is a one-way function, BERA cannot be converted into BGT.

Reach out to staking@chorus.one to get started or to learn more.

To read more about Berachain, we recommend the official documentation available in docs.berachain.com.

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Welcome back to the another edition of the (Re)staking Synopsis, your go-to source for the latest in Ethereum staking, presented by Chorus One.

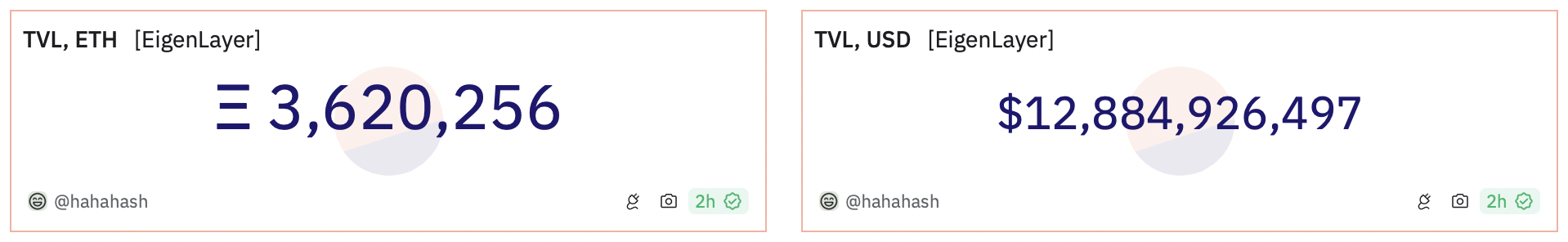

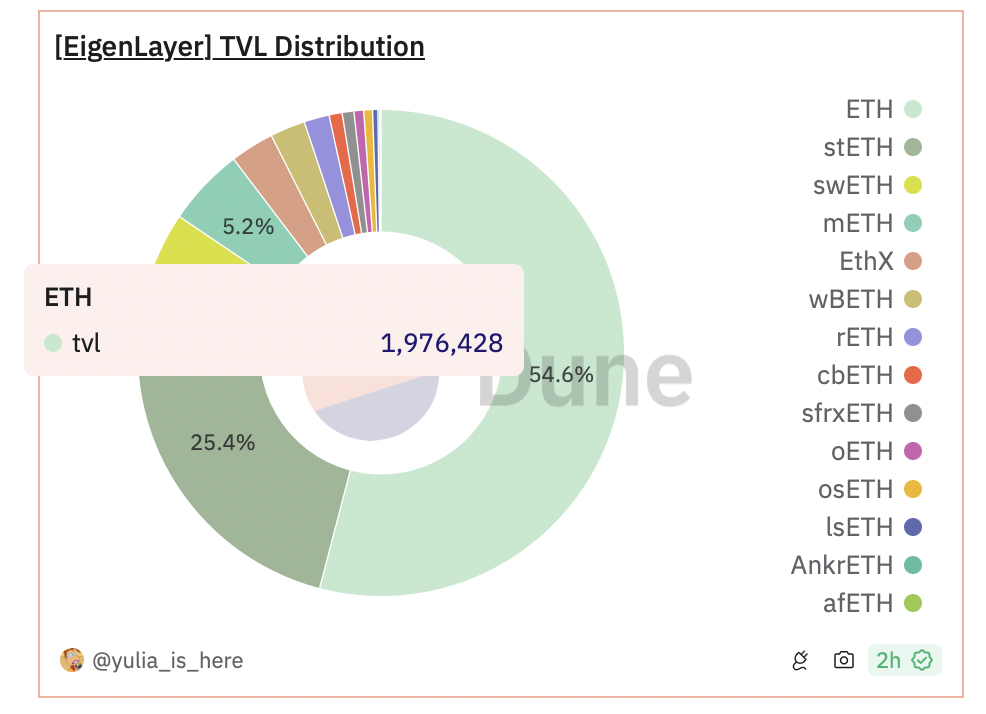

Cutting right to the chase: EigenLayer now holds the second spot in Total Value Locked (TVL) for a protocol, boasting over $12.8 billion USD (~3.6 million ETH) restaked. Impressively, nearly 2 million ETH has been natively restaked via EigenPods, marking a significant surge in restaking activity.

Additionally, the EigenLayer and EigenDA Holesky Testnet is live and thriving, with a staggering total of 157,433.0897 ETH already restaked! After a seamless testing phase on Goerli, we're thrilled to support this new phase as we progress towards Mainnet operations.

With a meticulously crafted AVS strategy, we prioritize the safety of the funds delegated to Chorus One. Learn more about restaking with Chorus One: https://forum.eigenlayer.xyz/t/operators-mainnet-campaign/12828/145?u=chorusone

Without any further ado, let’s dive in.

(Source: Dune Analytics)

OPUS Dedicated enables you to set up dedicated ETH validators, and directly restake your staked ETH with EigenLayer in a few clicks.

Note: At present, you can only deposit your staked ETH into EigenLayer; the option to delegate to Chorus One will be possible upon the EigenLayer Mainnet.

We will notify you once the delegation feature on EigenLayer becomes operational, indicating that it's time to delegate your restaked ETH. At that point, you will be able to delegate to Chorus One with just a few clicks.

How to restake ETH with EigenLayer

OPUS Pool enables you to stake any amount of ETH, mint osETH, and restake a variety of LST’s including osETH, cbETH, stETH, and more directly with EigenLayer in a just a few clicks.

Note: Restaking LSTs with EigenLayer is currently on hold and will resume once the deposit cap is raised. In the meantime, you are welcome to use OPUS Pool to stake any amount of ETH and mint osETH.

Visit OPUS Pool

How to Stake ETH and mint osETH

Read it here.

MEV-Boost targets the highest bid for Ethereum block space. However, a glitch arises when blocks include withdrawals, distorting the MEV valuation and making some bids appear more valuable than they really are, leading to losses for proposers.

Beyond individual losses, this issue has wider implications for the Ethereum ecosystem, inflating proposers' profits, cutting down overall transactions and gas usage, and consequently, decreasing ETH burning.

Our research team analysed the full impact of this bug, originally published on ETHResearch.

We explore how Ethereum's resilience is shaped by client diversity, offering an in-depth analysis of two of its most prominent Consensus Layer (CL) clients: Lighthouse and Teku.

Read it here.

If you’re interested in staking/restaking with Chorus One, or learning more, simply reach out to us at info@chorus.one and we’ll be happy to get back to you!

Additionally, if you’d like us to share further resources on any topic, please let us know!

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.